Board of Trustees

We are governed by a Board of Trustees with twenty-one voting members from a cross section of citizens from the district. School officials also serve on an advisory basis with no voting powers. Each Trustee serves for a three year term with one third of the Board’s terms expiring each year. This maintains continuity while bringing in fresh minds and ideas annually.

We are governed by a Board of Trustees with twenty-one voting members from a cross section of citizens from the district. School officials also serve on an advisory basis with no voting powers. Each Trustee serves for a three year term with one third of the Board’s terms expiring each year. This maintains continuity while bringing in fresh minds and ideas annually.

|

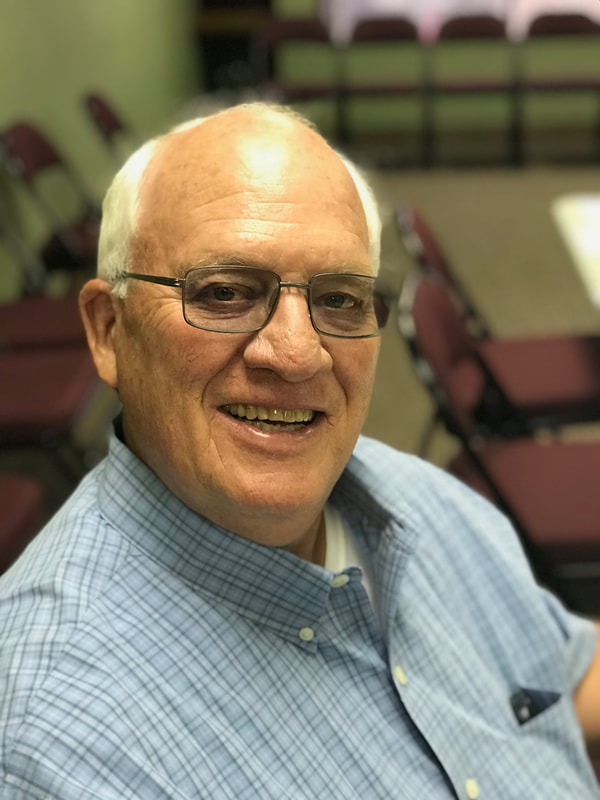

OFFICERS

Jim Corbin, President Heidi Ashford, Vice President Jared Grell, Treasurer Billie DeBoard, Secretary |

TRUSTEES

|